Table of Contents

Vestis Corp (NYSE: VSTS) is a name that’s becoming increasingly familiar to investors, especially following recent developments that are reshaping its future prospects. While the company may not yet be a household name, its ongoing restructuring and performance in the stock market are drawing attention from both analysts and investors. In this blog post, we’ll take an in-depth look at VSTS stock, its current standing, recent analyst ratings, and what the future could hold for this evolving company.

A Quick Overview of Vestis Corp (VSTS)

Vestis Corp operates in a competitive industry, offering products and services that cater to diverse business sectors. The company has been striving to improve its market presence and financial performance by enhancing customer service, optimizing sales force productivity, and bolstering revenue growth. These efforts have been met with varying degrees of success, as reflected in the stock’s recent performance and the cautious yet optimistic outlook from analysts.

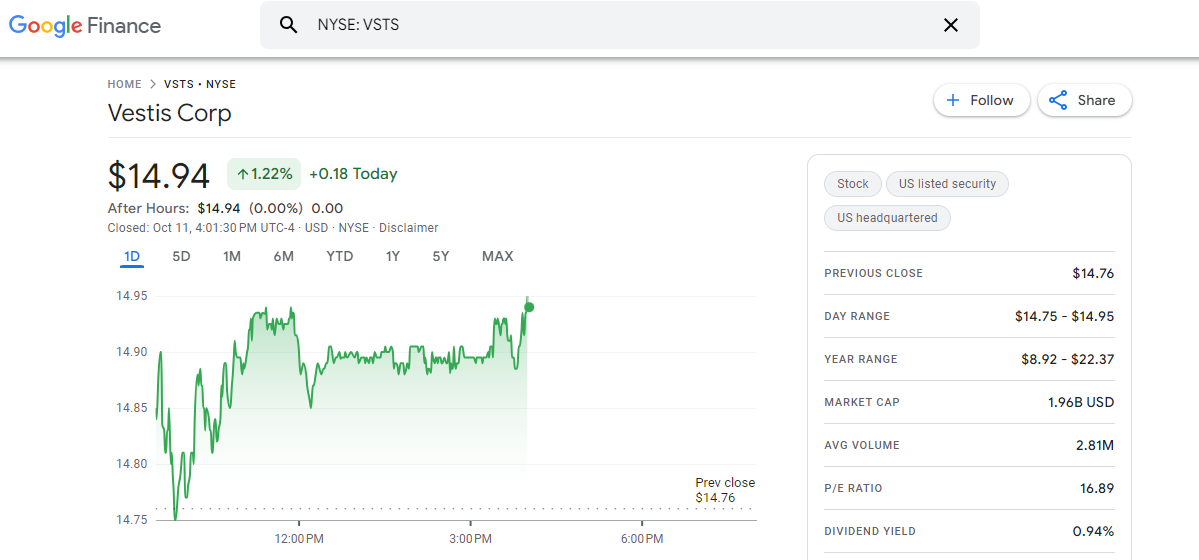

Recent Stock Performance of VSTS

In recent months, VSTS stock has experienced both gains and setbacks. While the company has made significant strides in certain areas, such as securing new business contracts and increasing customer retention rates, it’s also been grappling with revenue challenges. For example, the company’s third-quarter earnings report indicated a slight decrease in year-over-year revenue, down by 1.6%. Despite this, adjusted EBITDA remained steady at $87 million, signaling some resilience amidst broader market pressures.

From a stock performance perspective, Vestis has seen a notable return over the last three months, with a 27.41% price total return. This uptick suggests that investors are cautiously optimistic about the company’s long-term potential, even as analysts predict a longer road to full margin recovery.

Analyst Opinions: A Mixed Outlook for VSTS

One of the most influential voices in the financial world, Goldman Sachs, recently reiterated its Neutral rating for VSTS stock. The firm maintained its price target of $13.60, reflecting its cautious outlook on the company’s near-term prospects. According to Goldman Sachs, while Vestis has made headway in key areas such as price realization and customer service improvements, there is still much work to be done.

Goldman Sachs has adjusted its medium-term revenue growth and EBITDA margin estimates for the company, projecting that it will take more time for Vestis to achieve sustainable margin growth. For fiscal years 2025 and 2026, the firm has revised its revenue growth estimates down to 1% and 3.5%, respectively, from the previously anticipated 2% and 4%. EBITDA margin estimates for the same period have also been lowered, with projections for fiscal 2025 now sitting at 12%, down from an earlier estimate of 13%.

Vestis’ Financial Health and Restructuring Efforts

One of the key factors influencing VSTS stock’s performance is the company’s ongoing restructuring efforts. Vestis has been working to implement systemic changes that are necessary to drive growth and improve margins. This process, however, is far from straightforward. It requires time, resources, and a concerted effort across multiple departments within the company.

Despite these challenges, Vestis has shown a commitment to its long-term strategy. The company’s board of directors recently approved a quarterly cash dividend of $0.035 per share, signaling confidence in its future performance. Additionally, the company has been in discussions regarding a potential acquisition with Elis SA, a move that could further strengthen its market position.

The Path Forward: What Investors Should Watch For

For investors considering VSTS stock, there are several key factors to keep an eye on. While the company’s recent performance has been mixed, there are signs that its long-term strategy could pay off. However, the timeline for achieving these goals may be longer than initially expected.

- Revenue Growth Projections: Goldman Sachs’ recent revisions to Vestis’ revenue growth projections for 2025 and 2026 indicate a slower-than-expected recovery. While the company is still expected to grow, the pace of that growth may be more gradual than investors would like.

- EBITDA Margins: The company’s ability to improve its EBITDA margins will be crucial to its long-term success. Goldman Sachs has lowered its margin projections for the coming years, but if Vestis can successfully implement its restructuring efforts, there may be upside potential in the future.

- New Business Wins: One bright spot for Vestis has been its ability to secure new business contracts and improve customer retention rates. These factors could help drive future revenue growth and improve the company’s overall financial health.

- Potential Acquisition: The ongoing discussions with Elis SA could lead to a significant acquisition that may bolster Vestis’ market position and provide a catalyst for future growth. Investors should watch for any developments in this area.

Other Analysts Weigh In

In addition to Goldman Sachs, other analysts have provided their own assessments of VSTS stock. Stifel and Baird have both maintained their hold and neutral ratings, respectively, reflecting a cautious approach to the company’s near-term prospects. On the other hand, Jefferies has taken a more optimistic stance, raising its price target to $18.00 and maintaining a Buy rating on the stock.

Jefferies’ bullish outlook reflects confidence in the company’s long-term potential, particularly in light of its restructuring efforts and recent business wins. However, like Goldman Sachs, Jefferies also acknowledges the challenges that Vestis faces in the near term, particularly when it comes to achieving sustainable margin growth.

A Look at Vestis Corp’s Market Position

Vestis Corp’s current market position is another important consideration for investors. According to data from InvestingPro, the company’s market capitalization stands at $1.92 billion, with a P/E ratio of 14.32. This relatively modest valuation reflects the market’s cautious outlook on the company’s near-term prospects, but it also suggests that there could be room for growth if the company’s restructuring efforts are successful.

One of the factors working in Vestis’ favor is its profitability over the last twelve months. Despite the challenges the company has faced, it has managed to remain profitable, and analysts predict continued profitability in the coming year. This supports Goldman Sachs’ unchanged fiscal year 2024 estimates and suggests that the company’s financial foundation remains relatively stable, even as it works to improve its margins.

Should You Invest in VSTS Stock?

So, is VSTS stock a good investment? The answer largely depends on your investment strategy and risk tolerance. For investors with a long-term outlook, Vestis Corp could represent a compelling opportunity. The company’s restructuring efforts, new business wins, and potential acquisition with Elis SA all point to future growth potential.

However, it’s important to keep in mind that the road to recovery may be longer than initially anticipated. Goldman Sachs’ revised revenue growth and EBITDA margin estimates reflect the challenges that the company still faces. If you’re looking for a stock with immediate growth potential, VSTS may not be the right choice at this time. But if you’re willing to be patient and have confidence in the company’s long-term strategy, Vestis Corp could offer significant upside potential down the road.

Conclusion: A Stock to Watch

VSTS stock is certainly one to watch in the coming months. While the company’s near-term prospects may be uncertain, its long-term potential is clear. With ongoing restructuring efforts, new business wins, and the possibility of a significant acquisition on the horizon, Vestis Corp is positioning itself for future success.

As always, it’s important to do your own research and consider your own financial goals before making any investment decisions. VSTS stock may not be the right fit for every investor, but for those with a long-term perspective, it could offer an intriguing opportunity.

In summary, Vestis Corp is in the midst of a transformation, and while the path to full margin recovery may be longer than expected, the company’s ongoing efforts could ultimately pay off for patient investors.

Here are 10 frequently asked questions (FAQs) related to Vestis Corp and its stock performance:

- What is Vestis Corp (VSTS)?

- Vestis Corp is a company offering products and services to various business sectors. It has been undergoing restructuring efforts to improve its customer service, sales force productivity, and financial performance.

- Why did Goldman Sachs maintain a Neutral rating on VSTS stock?

- Goldman Sachs maintained its Neutral rating because, while Vestis is making progress in its restructuring efforts, the firm believes the company will take longer than expected to achieve significant margin recovery.

- What is the current price target for VSTS stock by Goldman Sachs?

- Goldman Sachs has set a price target of $13.60 for VSTS stock, reflecting a cautious outlook on the company’s near-term financial performance.

- How is VSTS performing in terms of revenue growth?

- Vestis Corp’s fiscal year 2024 revenue estimates remain unchanged, but growth estimates for fiscal years 2025 and 2026 have been revised down to 1% and 3.5%, respectively.

- What are the expectations for VSTS EBITDA margins?

- The expected EBITDA margins for fiscal years 2024 and 2025 have been adjusted to approximately 12% and 12.5%, lower than previous estimates of 13% and 14.5%.

- How has VSTS stock performed in recent months?

- VSTS stock has shown a 27.41% price total return over the last three months, indicating investor optimism about the company’s restructuring efforts despite the projected longer recovery timeline.

- What is Vestis Corp’s market capitalization and valuation?

- Vestis Corp’s market capitalization is approximately $1.92 billion, with a P/E ratio of 14.32, which indicates a relatively modest valuation.

- How does the potential acquisition of Elis SA impact VSTS stock?

- The potential acquisition of Elis SA could strengthen Vestis’ market position and provide a catalyst for future growth, although there is no definitive update on the acquisition yet.

- What other analysts have provided ratings for VSTS stock?

- In addition to Goldman Sachs, Stifel and Baird have maintained their hold and neutral ratings, while Jefferies has given a Buy rating and raised its price target to $18.00.

- Should I invest in VSTS stock?

- Investing in VSTS depends on your long-term outlook and risk tolerance. While the company shows potential for future growth, its restructuring efforts and financial recovery may take time, making it more suited for patient investors.